iowa homestead tax credit calculator

Credits and exemptions are applied only to annual gross net taxes total. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1.

Download 89 1 Relief Calculator Free Fy 2021 22 Ay 2022 23 Simple Tax India

How Much Is a Homestead Exemption in Iowa.

. For assistance call the Scott County Treasurer at 563-326-8664. Any Iowa resident who owns a home and resides there is eligible to take advantage of the states homestead credit. Find out more in our article.

5154809388 REMAX Concepts 661 NE Venture Drive Waukee IA 50263. No homestead tax credit shall be allowed unless the first application for homestead tax credit is signed by the owner of the property or the owners qualified designee and filed with the city or county assessor on or before July 1 of the current assessment year. You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028.

This Property Tax Calculator is for informational use only and may not properly indicate actual taxes owed. 701801425 Homestead tax credit. The credit will continue without further signing as long as it continues to qualify or until is is sold.

Iowa homestead tax credit calculator - Lasonya Van. Iowa Capital Gains Tax Calculator. 4 Reduces Taxable Value by 4850 pursuant to Iowa Code Section 4251.

Homestead Tax Credit Sign up deadline. Equals the Net Taxable Value divided by 1000 multiplied by the Tax Levy Rate and rounded to the nearest cent. Tax Credits.

Equals 100 Actual Value multiplied by the appropriate Rollback Rate. As with the Homestead Tax Credit the exemption remains in effect until the property owner is no longer eligible. Property owners must sign with the City or County Assessor and qualify under standards set by the State of Iowa.

If you live in Palm Beach County in a house valued at 370000 after the homestead your property taxes are 4851 based on the average tax rate of 1311 percent. This reduction in the amount of credits and exemptions will occur when the amount of funding received from the State for the credits and exemptions is less than the calculated amount of credits and exemptions for each applicable taxable property. Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed.

If the homestead tax credit computed under this section is less than sixty-two dollars and fifty cents the amount of homestead tax credit on that eligible homestead shall be sixty-two dollars and fifty cents subject to the limitation imposed in this section. New applications must be made with the Assessor on or before July 1 of the year the exemption is first claimed. Veterans Affairs Commission Agenda Minutes.

Attorney Thomas Laehn. This exemption is a reduction of the taxable value of their property amounting to a maximum. The homestead tax credit allowed in this chapter shall.

January 8 2021 356 PM. If you live in a house with the same evaluation in Miami-Dade County you will pay 4736 in property taxes based on a rate of 1280 percent. Scroll down to the Homestead Tax Credit section and click on the link that states.

Tuesday 31 May 2022 Edit Forbes advisors capital gains tax calculator helps estimate the taxes youll pay. How much is the homestead tax credit in Iowa. Learn About Property Tax.

CACTAS stands for Tax C redit A ward C laim and T ransfer A dministration S ystem and refers to the online system supporting the tax credit administration responsibilities of IDR and other State agencies that facilitate tax. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. To submit the application electronically click on the Submit.

Welcome to CACTAS. File a W-2 or 1099. This exemption is worth the taxes calculated on 2778 for WWI veterans and 1852 for all others after that time.

Clerk of District Court. July 1 This credit is calculated by taking the levy rate times 4850 in taxable value. For most taxpayers the Homestead Credit equals 4850 divided by 1000 multiplied by the Tax Levy Rate multiplied by 77.

Fill out the application. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the. Smaller parcels may qualify in they are contiguous to a qualifying parcel and under the same ownership.

The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa. Adopted and Filed Rules. Apply online for the Iowa Homestead Tax Credit.

This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the disabled veteran tax credit and clarifies the eligibility of a person who has received multiple discharges from service for the disabled veteran tax credit. Other credits or exemptions may apply. Parcels with an Agricultural Class of at least 10 acres in size qualify for the Ag Land Credit.

Confirm that the ownership record is correct you should be listed. For additional information and for a copy of the application please go to the Iowa Department of Revenue web site. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

Learn About Sales. What is a Homestead Tax Credit. Market Value and Appeals.

Click on the Save button at the top left of the screen. Law. Iowa Homestead Tax Credit Calculator.

The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is based on the first 4850 of Net Taxable Value. Applicants must own and occupy the property as a homestead on July. In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the entire amount of the Taxable Value of the.

There is a restriction of 40 acres covered under a homestead exemption in rural areas and a limit of 12 of an acre in urban areas. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. 8011 Application for credit.

Residents Calendar of Events.

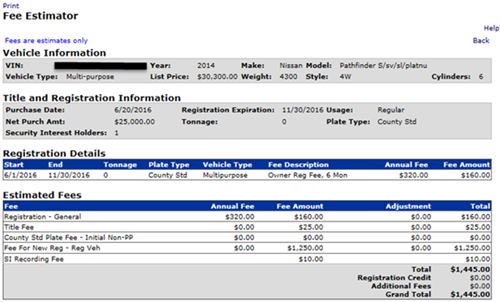

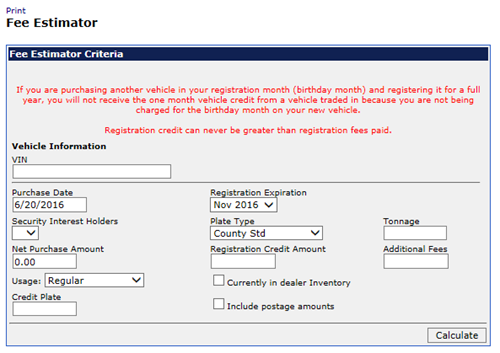

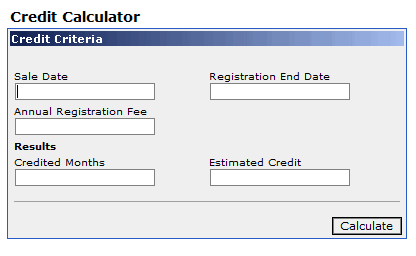

Calculate Your Transfer Fee Credit Iowa Tax And Tags

What Is A Homestead Exemption And How Does It Work Lendingtree

Our Free Cost Of Living Calculator Allows You To Compare The Cost Of Living In Your Current City To Another Retirement Calculator Financial Advisors Retirement

Should You Move To A State With No Income Tax Forbes Advisor

How The 2022 Federal Geothermal Tax Credit Works

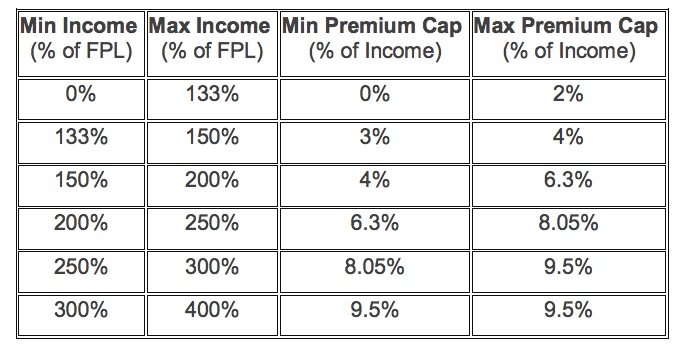

Obamacare Calculator Subsidies Tax Credits Cost Assistance

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Income Tax Calculator For Fy 2020 21 Vakilsearch Blog

Business Property Tax Credit Conversion To Business Property Tax Partial Rollback Reduction Iowa League

Pin By Julissa Alvarez On Irs Taxes Calculator Casio Cool Desktop

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Use The Interactive Home Loan Emi Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payable A Home Loans Best Home Loans Apply For A Loan

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Sales Tax Calculator Credit Karma

Calculate Your Transfer Fee Credit Iowa Tax And Tags

More Childless Adults Are Eligible For Earned Income Tax Credit Eitc